Estimated Tax Payments Due Sept. 15

- Viktoriya Barsukova, EA, MBA

- Sep 6

- 1 min read

September isn’t just the start of cooler weather—it’s also the deadline for third-quarter estimated tax payments. The IRS requires these payments by September 15, 2025.

Who should pay?

You may need to make an estimated payment if you:

Expect to owe $1,000 or more when filing your return, and

Your withholding and credits won’t cover at least 90% of this year’s tax or 100% of last year’s tax.

This often applies to:

Gig workers and freelancers

Small business owners and partners

Investors

Retirees with significant non-wage income

Many people use last year’s tax as a safe guide, but if your 2025 income is higher, adjust to avoid penalties.

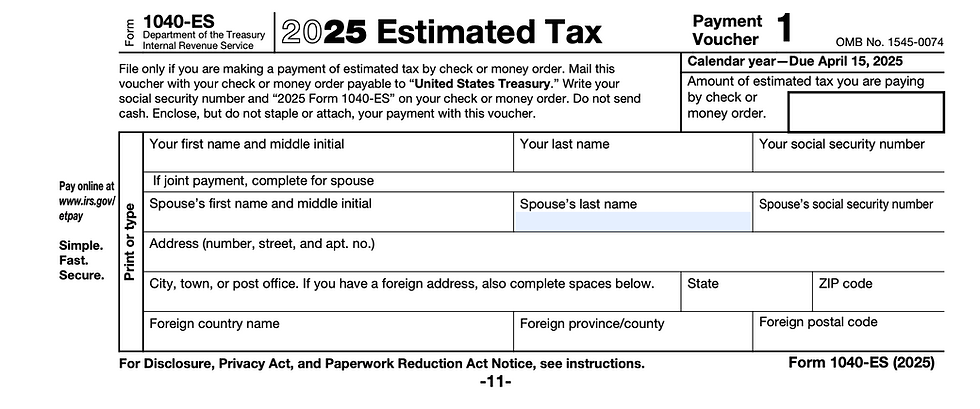

How to pay:

IRS Direct Pay or EFTPS – fastest and most reliable

Credit/debit cards (note: processing fees may apply)

Paper check (still accepted, but slower)

Special note: Taxpayers in federally declared disaster areas may qualify for extra time. Check the IRS “Around the Nation Disaster Relief” page for the latest updates.

For a helpful overview, see this quick explainer:https://www.youtube.com/watch?v=eMxTgPtpvmE

Comments