top of page

All Posts

Who Qualifies for the Earned Income Tax Credit (EIC)?

Earned Income Tax Credit (EIC) Earned income tax credit eligibility requirements explained for tax professionals, covering qualifying children, income rules, filing status and common IRS pitfalls If you prepare returns for individuals and families, you already know the earned income tax credit (EIC) is one of the most valuable refundable credits out there. It can reduce a taxpayer’s tax bill and, for many clients, it can produce a larger refund even when little or no federal

Viktoriya Barsukova, EA, MBA

Jan 194 min read

Tips for filing LLC returns

San Diego Precision Tax Service Inc Here are a few of the top questions we get and their answers for a refresher just as filing season gets underway. The first question is, if a California resident sets up a single-member LLC in another state, does the LLC need to file in California? There will be no business transactions in California and all the investment income will be coming from other states. The answer is yes. If the member is a resident, they’re required to file For

Viktoriya Barsukova, EA, MBA

Jan 183 min read

Should You Skip Home Office Depreciation to Avoid Recapture Tax?

Should You Skip Home Office Depreciation to Avoid Recapture Tax? If you are like most taxpayers, the words “recapture tax” describe something you want to avoid. To avoid recapture of depreciation deductions on the home office, taxpayers do not claim depreciation. When the taxpayer does not claim depreciation, the tax law imposes the allowed-versus-allowable depreciation rule. For this purpose: • The depreciation allowed is the amount you claimed on your tax return. • The dep

Viktoriya Barsukova, EA, MBA

Jan 175 min read

When Work Clothing Is Deductible

Deductible Clothing As a general rule, clothing is not tax-deductible, even if it is purchased for work or business use. The only exception is if the business clothing is not suitable for street wear. Clothing That Is Not Tax-Deductible Clothing used for work or business is not deductible if it is suitable for everyday wear.¹ This is so even if the clothing was purchased solely for work and is not worn outside of work. Examples of clothing that is not deductible are business

Viktoriya Barsukova, EA, MBA

Jan 156 min read

2025 Tax Law Wrap-Up: What Matters for the 2026 Filing Season

Tax Law Wrap-Up As tax professionals gear up for the 2025 filing season, staying ahead of the latest changes is essential. This year’s wrap-up brings together the inflation-adjusted amounts you’ll rely on most, along with the critical updates introduced in the One Big Beautiful Bill Act (OBBBA; H.R.1). Here you’ll find the practical details you need to brief clients with confidence and refresh your organizers, checklists and workpapers before the season hits full stride. 2025

Viktoriya Barsukova, EA, MBA

Jan 1316 min read

Your Must-Have “2026 Tax Resource Guide”

2026 Tax Resource Guide The “2026 Tax Resource Guide” is your go-to desktop reference. It puts commonly needed tax information at your fingertips. Do You Need This on Your Desktop? In the fast-paced, complicated world of taxes, having instant access to key information can make a difference. This handy-dandy reference is your quick-access tool—no more wasting time digging through files or searching online. With this guide on your desktop, you have a big chunk of what you need,

Viktoriya Barsukova, EA, MBA

Jan 121 min read

IRS Releases 2026 Standard Mileage Rates

IRS Releases 2026 Standard Mileage Rates The IRS announced the 2026 standard mileage rates , providing tax professionals with an important planning update for clients who drive for business, medical, charitable or qualified moving purposes. Beginning Jan. 1, 2026 , the business standard mileage rate increases to 72.5 cents per mile , up 2.5 cents from 2025. The standard mileage rate for medical travel decreases to 20.5 cents per mile , down 0.5 cents , while the charitable m

Viktoriya Barsukova, EA, MBA

Jan 121 min read

Choices for entities that were never properly closed in California

It’s not uncommon for clients to just close up shop when a business fails without going through the proper steps to formally dissolve the entity with the California Secretary of State. When this happens, the owners will receive a bill from the FTB for the annual $800 minimum tax plus penalties and interest. This can quickly add up if the business hasn’t operated for years. Choices for entities that were never properly closed in California Here are some options to help your cl

Viktoriya Barsukova, EA, MBA

Jan 113 min read

Protect Yourself from Scams

Protect Yourself from Scams Scammers may pose as IRS or FTB employees to deceive taxpayers into sending money or sharing personal information. Common scams include texts, emails, calls, fake websites, and fraudulent mail. To protect yourself: Do not reply to or click links in suspicious messages. If you are unsure, contact FTB directly to verify the request. For suspicious letters, call FTB at 800-852-5711 or visit the Notices and letters page for more information. Als

Viktoriya Barsukova, EA, MBA

Jan 71 min read

Federal vs. California Treatment of Meals and Entertainment Expenses Under IRC §274

IRC section 274 provides the general rule that no deduction is allowed for entertainment, travel, or gifts unless it is directly related to the active conduct of a trade or business. California generally conforms to section 274 prior to its amendment by the Tax Cuts and Jobs Act and the One Big Beautiful Bill Act. California does not conform to the TCJA and OBBBA amendments that eliminate the deduction for entertainment expenses, limit the employer’s deduction for meals provi

Viktoriya Barsukova, EA, MBA

Jan 63 min read

Why your tax preparer asks so many questions (and keeps your documents)

Why your tax preparer asks so many questions If you’ve ever wondered why a tax professional asks detailed questions or requests copies of documents you already provided, there’s a simple reason: federal law requires it. When a return includes certain credits or filing statuses, the IRS imposes strict “due diligence” rules on paid preparers. These rules exist to protect both you and the preparer from errors, audits, and penalties. What triggers due diligence Extra rules appl

Viktoriya Barsukova, EA, MBA

Jan 22 min read

Form 1099-DA Is Here—How It Will Impact Your Crypto Taxes

How Form 1099-DA Will Impact Your Crypto Taxes It took the IRS four years to finalize its cryptocurrency regulations, but crypto tax reporting is here. Starting with the 2025 tax year, custodial crypto platforms must report digital asset transactions on new IRS Form 1099-DA. The first Form 1099-DAs must be filed by March 31, 2026, if e-filing (March 2, 2026, if filed on paper). Starting in 2026, custodial brokers must report the cost basis of digital assets, which will make i

Viktoriya Barsukova, EA, MBA

Dec 27, 20259 min read

Solo Biz Owner? No Employees? Is the Mega Backdoor Roth for You?

Mega Backdoor Roth Say you prefer the Roth retirement account. If your income is too high to contribute to a Roth IRA, the backdoor Roth allows you to contribute to a traditional IRA and then convert that traditional IRA contribution of $7,000 ($8,000 if age 50 or over) to a Roth.¹ But if you have no employees and operate your business as a corporation or a sole proprietorship, you may want to utilize the mega backdoor Roth and invest up to $70,000 ($77,500 if you are age 50

Viktoriya Barsukova, EA, MBA

Dec 26, 20254 min read

The Hidden Benefits of Filing a Gift Tax Return

Gift Tax Return Most people never have to pay gift taxes, but they still may be required to file gift tax returns with the IRS. Such filings can be a burden, but they can also provide important benefits. What Is a Gift Tax Return? IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, must be filed by the person who makes a taxable gift (the donor), not the gift recipient (the donee).1 Donors who file gift tax returns rarely have to pay any gift tax.

Viktoriya Barsukova, EA, MBA

Dec 25, 202513 min read

2025 Year-End Tax Deductions for Existing Vehicles after OBBBA

Business tax deductions It’s time to examine your existing business and personal (yes, personal) cars, SUVs, trucks, and vans for some profitable year-end business tax deductions. In this article, first we will look at your prior and existing business vehicles that you or your pass-through business owns. Then we will take a look at your personal vehicles as a possible source for a last-minute, tax-saving deduction thanks to the One Big Beautiful Bill Act (OBBBA). Prior and Ex

Viktoriya Barsukova, EA, MBA

Dec 24, 20257 min read

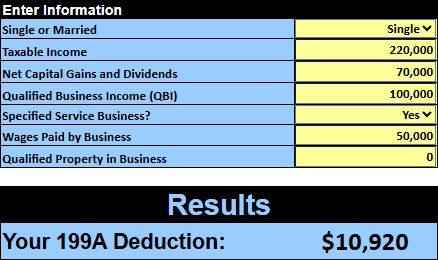

2025 Last-Minute Section 199A Tax Reduction Strategies

Section 199A Tax Reduction Strategies With all that happened in 2025, it’s easy to forget your Section 199A deduction. You may remember that the Tax Cuts and Jobs Act (TCJA) gave many pass-through businesses the Section 199A deduction as a no-effort, do-nothing 20 percent tax deduction based on defined business income. The One Big Beautiful Bill Act (OBBBA) made this do-nothing Section 199A deduction permanent. Here’s an example of how this do-nothing deduction works. With d

Viktoriya Barsukova, EA, MBA

Dec 22, 20256 min read

IRS Moves Toward All-Electronic Refunds: What You Need to Know

All-Electronic Refunds The federal government is phasing out paper checks. President Donald Trump issued an executive order last March requiring all federal agencies to transition from paper checks to electronic funds transfer to the extent permitted by law. All payments made to the federal government (taxes, fees, fines) will also eventually have to be made electronically, but this transition will only be made “as soon as practicable.”¹ The process has already started. The I

Viktoriya Barsukova, EA, MBA

Dec 18, 20254 min read

Practitioner Responsibilities Under Circular 230: A Q&A With IRS OPR

Practitioner Responsibilities Under Circular 230 Introduction During a live IRS Stakeholder Liaison session on professional conduct and tax practice, questions were addressed by Tom Curtin, a representative of the IRS Office of Professional Responsibility (OPR) . OPR administers and enforces Circular 230, which governs practice before the Internal Revenue Service. The discussion focused on emerging issues, including artificial intelligence, jurisdiction, and taxpayer data se

Viktoriya Barsukova, EA, MBA

Dec 17, 20253 min read

Outdated IRS Limit on Business Gifts

Gift Limit Questiona During the holiday season, I send gift baskets to colleagues, referral sources, and select customers. My purpose is to keep my name in front of these people for obvious business reasons. Can I write off the cost of the gift baskets as a business expense? Answer Yes, you may write off the gift baskets as business gifts but only up to $25 annually for each recipient.1 If the total cost of all your business gifts to one individual during the taxable year exc

Viktoriya Barsukova, EA, MBA

Dec 16, 20254 min read

Upcoming Rules for the New Trump Accounts

New Trump Accounts The IRS has released early guidance ( Notice 2025-68 ) explaining how the new Trump Accounts will work. These accounts are designed to help families save for a child’s future—similar to an IRA, but specifically for minors. What You Need to Know A Trump Account can be opened for a child under age 18. Parents, guardians, other individuals, and even employers may be able to contribute (final rules are still coming). While the child is under 18, funds can only

Viktoriya Barsukova, EA, MBA

Dec 15, 20252 min read

bottom of page